by Matt Margolis

If anyone follows the share price of Micron Technology (MU) I’m sure your first thought might be, “this stock already doubled and almost tripled over the last 12 months.” The answer is yes the Micron has gone from $9.23 on April 1, 2013 to $23.66 as of today’s close on March 31, 2014 (a whopping increase of 2.56x or 156% over the last 12 months). I’m going to argue that the supply and demand situation along with the macro economic environment driving the memory industry will drive Micron’s share price up another 156% over the next 12 months. I am officially initiating coverage on Micron and issuing a $61 – 12 month price target.

What is DRAM?

One of the main types of memory that Micron specializes in is Dynamic random-access memory (DRAM). DRAM is a type of random access memory that stores each bit of data in a separate capacitor within an integrated circuit. Since real capacitors leak charge, the information eventually fades unless the capacitor charge is refreshed periodically. Because of this refresh requirement, it is a dynamic memory as opposed to SRAM and other static memory. The main memory (the “RAM”) in personal computers is Dynamic RAM (DRAM), as is the “RAM” of home game consoles (PlayStation, Xbox 360 and Wii), laptop, notebook and workstation computers.

DRAM Consumption

DRAM consumption is driven by Mobile (35%) of the market and Servers (20%) of the DRAM market. Mobile DRAM consumption will grow at a 60-70% YOY clip in 2014 and server consumption will increase about 40% YOY. The next significant piece of DRAM consumption is Networking, which represents approximately 10% of the marketplace and that is growing 30-35% YOY driven by LTE build outs in China. The last piece of the DRAM market is PC’s and that area is growing at a 5% YOY rate at best. I have only been following Micron for the last 4 years but I have very excited about how Micron is and will continue to be a very big winner in the smartphone revolution that is still in its infancy.

DRAM, the Past, the Present and the Future

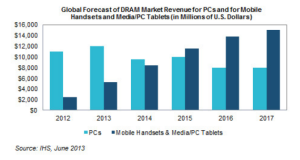

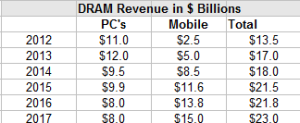

Micron’s DRAM business used to be tied to PC sales and PC’s have dominated the DRAM industry consumption since the 1980s but by 2015 Tablets and Mobile devices are expected to consume more DRAM than PCs. If you don’t this has been a remarkable shift in consumption, then you read to check out the chart below courtesy of IHS Technology.

Global mobile smartphone sales just surpassed non-smartphone sales in 2013 with a total market size of 1.8B handsets sold. A new report published today from IGR estimates that mobile sales will rise from 1.8B to 2.6B units by 2018 and smartphone sales will account for 85% of 2.2B units sold in 2018 up from 0.9B or just over 50% of mobile units sold in 2013, representing an increase of 1.3B annual smartphone unit sales by 2018. Smartphone sales are forecasted to increase from 900m in 2013 to 2.2B in 2018 representing an annual growth rate of 20%. On top of the unit growth rate, the amount of DRAM memory bits consumed in smartphones and tablets will continue to increase as mobile devices and tablets become more powerful and continue to perform a larger portion of our computing tasks each day.

The mobile DRAM marketplace is currently dominated by only 3 players, Samsung (48.9%), Hynix (25.9%) and Micron (23%) during Q4 2013. Samsung is mostly a supplier to themselves and Micron through their acquisition of Elpida has Apple as a mobile customer. Micron was the #4 player in the DRAM space but after they acquired Elpida for pennies on the dollar they jumped #3 and are currently in a horse race with Hynix for the #2 spot.

Conclusion

Micron’s DRAM revenue accounted for 50% of Micron’s record $4,042 million of sales recorded in Q4 2013. The DRAM marketplace is composed of just 3 significant players and the supply and demand equation is now in equilibrium. The 20% forecasted growth rate of smartphone sales through 2018 will continue to drive mobile DRAM bit growth even as the PC market continues to survive on little to no growth for the foreseeable future. Micron and the memory space may have been exposed to significant price fluctuation but in a market with only 3 major players and a significantly high cost of capital to enter the markets place, the supply and demand picture looks safe and so does Micron’s profits for the foreseeable future. Wall street analysts average earnings estimate is $2.98 per share in 2014 with a low estimate of $2.20 and a high estimate of $3.44. Looking ahead to 2015, the average wall street analyst estimate is $2.96 with a low estimate of $1.40 and a high estimate of $3.88.

Micron reported earnings of $0.77 per share in their Q1 2014 quarter against the average wall street estimate of $0.43 per share meaning Micron exceeded analyst estimates by $0.34 or 79%. The wall street analysts still think Micron is supplying memory to the PC marketplace and they just don’t understand the smartphone and tablet revolution that will drive Micron sales and earnings for the next 5 plus years!

Shares of Micron were up 8% today and today’s action is just the beginning of a terrific finish to 2014 for shares of Micron. The analysts are expecting Micron to earn $0.74 in Q2 2014 when they report on Thursday after the closing bell, but investors should expect another significant beat to Micron and additional price target increases from wall street. Micron should be valued at 15-20x 2015 earnings estimate of $2.98 per share, which would value the company at $45-60 today. I feel confident Micron will earn over $4.00 a share in 2014 and will challenge $5.00 per share in 2015. The Micron analysts are afraid to get in front of this memory earnings freight train, but the pure supply and demand economics along with macro economics surrounding smartphone conversions from non-smartphone mobile devices, will continue to fuel Micron’s earnings and share price for years to come. My recommendation is to buy Micron in advance of their Q2 2014 earnings announcement Thursday after the closing bell and to hold this volatile security for the next 12 months and enjoy a 165% return alongside me.

Full Disclosure: I am long MU and have no plans to buy or sell any holdings in the next 12 months

Interesting piece. As a fello Micron long , I am right there with you. However you have completely miseed the single largest oportunity for Micron overvthe next 5 years. NAND and SSD’s.Why not mention this $25 billion opportunity that is still in its infancy. I see MU at $100.00+ by 2016.

LikeLike

I will get into those. One step at a time for me :). I am very familiar with the mobile and tablet space so focusing on DRAM was a good entry.

LikeLike

Micron $100 by 2016? Excellent! Bought in at $9 and change and have been adding every pull back. I realized this gem back in 2012 just after dram prices bottomed out and the Elpida deal was announced. Good luck !

LikeLike

[…] On April 1, 2014 I dug into Micron’s hidden value and initiated coverage of with a $61 target. My in-depth review can be found here. […]

LikeLike

[…] I want to thank them joining the upgrade party but they are 7+ weeks late. In my April 1, 2014 post I gave Micron a $61 – 12 month target and my target was driven by the Supply and Demand of the […]

LikeLike

[…] I am long shares of Micron and maintain a $61 price […]

LikeLike