by Matt Margolis

I’ve been reading the feedback I received from several of my loyal followers as well as the various message board comments regarding sapphire cover screens, Apple’s iPhone 6 release date, and Apple’s WWDC that is set to kickoff on June 2nd. Listed below some of the questions I have recently received.

- When will Apple launch the iPhone 6?

- Will the iPhone 6 include a sapphire cover screen?

- Will a sapphire cover screen only show up on the high-end 5.5″ iPhone 6?

- Will sapphire be used on the iWatch?

I believe the answers to all of these questions are very important but the way all of GTAT’s shareholders are going to make some serious money is going to come down to analyst analytics. I’m sure you are wondering what am I saying? Well to be honest there are a handful of key data drivers that can turn Wall Street’s base case Apple annual revenue from $1 billion annually to of $2 billion in 2015 for JUST APPLE! Just for the record, the Obscure Analyst is estimating GT’s revenue from Apple at $2.2 billion for 2015.

The immediate impact on GTAT’s share price and Wall Street estimates once Apple announces sapphire cover screens on the iPhone 6 comes down to analyst analytics.

I’ve taken the last few days to digest some information to help everyone understand what the next impact will be to GTAT’s share price and valuation. Goldman Sachs indicated they anticipate Apple to sell 203 million iPhone units in 2015, which under Goldman’s bull case would lead to $2b and $2.00 EPS for GTAT in 2015.

It is also important to note that even though bloggers and various naysayers indicate that the iWatch will carry sapphire cover screens first, there is $0 of revenue for the iWatch assumed in any of the Wall Street estimates (for those who gave detail). I repeat there is $0 of revenue built into analyst forecast’s for sapphire iWatch cover screens for 2014, 2015 and 2016. The reason why Wall Street has $0 of revenue forecasted for the iWatch is directly related to the estimated full capacity of the Mesa, AZ sapphire plant.

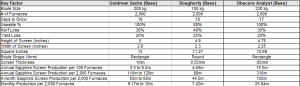

Mesa, AZ Sapphire Plant Capacity: Goldman Sachs, Dougherty & Company & The Obscure Analyst

I would first off like to tip my cap off to Dougherty & Company for producing one of the best Wall Street research reports I have seen on GTAT. My very high-grade has nothing to do with the $29 PT the company gave GTAT, but the breadth of understanding Dougherty demonstrated through its analysis of GT’s business.

The key data points that determine the Mesa, AZ sapphire plant capacity in terms of millions of sapphire cover screens are listed below:

- Boule Size

- Number of ASF Growth Furnaces

- Days to Grow a Boule

- Useable Boule %

- Kerf Loss %

- Yield Loss %

- Cover Screen Height

- Cover Screen Length

- Cover Screen Thickness

- Boule Form (Round versus Rectangle)

I’ve taken the base case from each analyst (Goldman, Dougherty and Obscure) and put them side by side. I’ve also modified some of the key data points and ran three different scenarios so everyone can see how much the capacity calculations can swing.

Base Case Key Differences:

- Screen Thickness: Goldman is modeling 1mm, Dougherty has the thinnest screen thickness model at only 0.55mm thick and Obscure is modeling 0.65mm.

- Boule Size: Goldman is modeling 200 kg, Dougherty 100 kg and Obscure 230 kg

- Form & Useable %: Goldman and Obscure are rectangular and 100% and Dougherty is round and 80%

- Average Screen Size: Goldman 13 square inches, Dougherty 11.27 square inches and Obscure 10.69 square inches

Base Case

Maximum Capacity (Goldman 120m, Dougherty 89m and Obscure 310m)

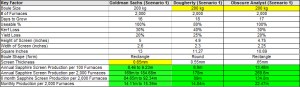

Scenario #1 (Align Boule size and Relative Screen Thickness)

Maximum Capacity (Goldman 185m, Dougherty 223m and Obscure 270m)

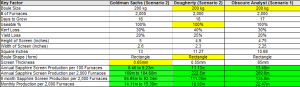

Scenario #2 (Align Boule size, Relative Screen thickness and Form)

Maximum Capacity (Goldman 185m, Dougherty 223m and Obscure 270m)

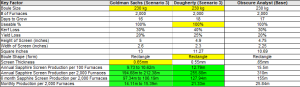

Scenario #3 (Max Boule size, Relative Screen Thickness and Form)

Maximum Capacity (Goldman 212m, Dougherty 256m and Obscure 310m)

Conclusion:

GTAT’s CEO informed investors during the conference call that Apple would be fully utilizing the sapphire being produced by GTAT. Currently Goldman Sachs and Dougherty Group are estimating that GTAT will sell nearly 100% of its annual sapphire capacity to Apple, but at a clip of only $1 billion per year or approximately $10 ASP based on 100 million units sold. Goldman and Dougherty have $0 of revenue built-in for Apple’s iWatch.

There are several key data points that are used to calculate the capacity of the Mesa, AZ sapphire plant and there are drastic differences between Goldman Sachs and Dougherty Group capacity models. Goldman Sachs’s boule size is twice the size of the boule used by Dougherty, but when it comes to sapphire screen thickness estimations Goldman’s estimated screen thickness was nearly twice as thick as Dougherty.

I ran three different estimation scenarios in an effort to modify the data outliers and to better align the peer group to come up with a better consensus of the estimated sapphire capacity of the Mesa, AZ plant. The boule size in Dougherty’s model (100 kg) is less than half of what should be used (200 kg+). Additionally, the sapphire cover thickness estimated by Goldman Sachs is likely over estimated by 40% or more. The form factor (round) used by Dougherty should be replaced by a rectangular boule form, which would lead an increase in the useable sapphire percentage in the company’s model. The results of the scenario modeling (scenario #2) indicate that the maximum annual capacity of the Mesa, AZ sapphire plant is likely between 185m and 270m sapphire screens or $1.85B billion and $2.7 billion of annual revenue assuming a $10 ASP.

I am currently estimating that the Mesa, AZ sapphire plant at full annually capacity can produce 310m of annual screens or $3.1B of annual revenue, however I am only estimating $2.2B of revenue or a 71% conversion rate in my 2015 estimates. The major upside that has not been priced into GTAT’s share price is the fact that the Wall Street analysts have grossly under estimated the annual sapphire capacity of the Mesa, AZ plant. The difference is worth $20+ of additional share value if Apple not only produces a sapphire cover screen for the iPhone 6 but also for the iWatch in 2014. If Apple produces sapphire cover screens for both the iWatch and the iPhone it will result in annual Apple revenue, that will be closer to$2 billion versus the $1 billion estimated by the Wall Street analysts in 2015. If GTAT generates $2 billion of annual revenue from Apple beginning in 2015 it will result in base EPS of $2.00+ for 2015, 2016 and beyond.

There is only one question remains unanswered. Whose “analytics” hold more water, the Wall Street analysts or the Obscure Analyst? The right decision may make you a lot of money!

I am long GTAT

Boule size according to GTAT is 100, 115 and shortly I think the new size was 165kg so there is a conflict with the numbers you present. Can you clarify?

Very long GTAT

LikeLike

Boule size of the “captive” machines that are currently being utilized are “significantly” larger than 165kg. GT made comments in fall of 200 kg but I have reason to believe the upper end could be 230kg.

LikeLike

In my humble opinion June 2nd will be a major day for GTAT investors:

1) If Apple announces Sapphire will be used for the iPhone this is great! But the timing is even more important to achieve the $600-800 million guidance .

2) If Apple announce a new product category with Sapphire , calculations will have to be redone , and hopefully $600-800 million is achieved.

3) If Apple does announce a new iPhone without mentioning Sapphire , speculation and volatility will hurt the stock price.

4) ALL the future revenues will revised after JUNE 2nd

5) If the new iPhone launch is in August this year , it is very probable that it production build up started and that Sapphire screen are being used but GTAT is not allowed to recognize the revenue yet .

6) I am also hoping for TWO important launches this year : APPLE will certainly not combine a new product category launch with a product upgrade!

Very bullish on GTAT in the longterm , hopefully in the short term we don’t suffer , I still do not get it why so many are short ? What do they know ?

LikeLike

@PAT – WRT short interest….I have traded GTAT for a long time. A year ago the stock went below $3. The short interest then was probably higher as a % of float than today. You would have to ask yourself what gain is possible at $3 on the downside??? The point is that short logic is rarely comprehensible.

Second, deferred recognition should not require recognition delayed beyond shipping to and acceptance by the customer and installation if that is required… I “think” that worst case on the screens should be installation on an iPhone which is well before shipping. Perhaps I am wrong as this is a relatively new concept for me.

LikeLike

It seems alot of investors are looking at june 2 WWDC for a saphirre iphone 6 announcement and i think this is a setup for disappointment just like the rumor that gtat would upgrade their guidance for the 2nd half of 2014. A part of this selloff is because short term investors got this upgraded guidance into their heads and it should of never been there in the first place. Now we have this rumor that the saphirre iphone6 is going to be announced at WWDC on June2. Whats going to happen when this so called rumor is not announced? If u are in gtat for the long term than this date could mean another big selloff if this RUMOR is not proven and i would have some dry powder set aside for this so called disappointment. I was an investor in aapl starting in 2008 and then went into the aapl supplier space with TQNT and now am an investor in another supplier (GTAT) of aapls. During that time there have never been so many rumors about another iphone than about this iphone6. I think investors are setting themselves up for disappointment on June 2 even though the announcement should of never been on the radar to begin with this early in the year. Hope i am wrong but will have extra funds for that day when the shorts and daytraders hurt the gtats stock price that day over another rumor.

LikeLiked by 1 person

I completely agree. AAPL doesn’t make big announcements about products until they’re ready to stock the shelves. I believe we’re too early in the cycle for the iPhone 6 release. With GTAT working out the bugs and getting their plant up to speed, AAPL is busy testing. My best case guess is an end of August announcement with product hitting the stores in September. I also think it will take a full 2 quarters of big earnings beats for GTAT stock to really get the attention of everyone. By next year at this time there should be significant interest and hopefully we won’t get caught in a downdraft of a general market meltdown.

LikeLike

Carl, I disagree with you. Apple needs to regain momentum with the iPhone6 and the WWDC is a great place to do it. If it doesn’t happen I expect us to test lower levels with great buying opportunities.

LikeLike

Hi Carl, I did a quick sanity check on my statement on iPhone 6 at WWDC and it seems that traditionally, Apple makes the announcements 30 days or so before general availability to avoid killing the existing product sales. Since there was an announcement recently that iPhone sales were exceeding expectations, Apple would be crazy to early announce iPhone 6.

LikeLike

Barry they were selling more 4s which has nothing to do with the 5s. The markets and people who buy the 4s will not be people that will flock to the stores to buy the iPhone 6. The iPhone 5s has a massive trade in program to rid themselves of the units. Check the ASP last quarter for iPhones it was way down to mix (higher 4s sales)

LikeLike

I agree , too much is expected of WWDC June 2nd. Like I said before , the shorts and the short term traders can create pain to longterm investors . IN THE LONG TERM I still feel we are investing in a great company !!

LikeLike

How about a boule size that has no upper limit? Apple has a patent for continuous sapphire growth and pulling out a thin sheet of sapphire in a continuous fashion. Just keep feeding the furnace and growing sapphire. Perhaps that is the magic sauce to making sapphire affordable???

LikeLike

I’m trying to find out if that is an option for 2014 production. Obviously without getting in there to see it’s anyone’s guess but the patent is available and so is the need. Question is can they get it ready to roll in Mesa?

LikeLike

Matt trying to understand your screen size estimates. Most of the rumors/leaks point to 4.7″ with 138mm x 67mm(5.43 x 2.64) = 14.33 sq in and 5.5″ with 157mm x81mm(6.18 x 3.19) = 19.71 sq in.

The cover glass would cover the entire top surface including the areas above/below the screen for home button/sensors.

LikeLike

With Apple putting so much money into sapphire in its OWN research and patents, I am expecting them to buyGTAT at some point. They love buying and controlling technology….I just hope it is a year from now at $50-$100 not now at about $25

LikeLike

Matt,

I appreciate all the work that’s being put into your analysis of GTAT. If I may make a suggestion it would be to also focus in the areas of what might also derail GTAT going forward. Specifically, I find it super hard to make projections into the out years when so much could happen. For example, will Corning sit on it’s hands as GTAT pushes into sapphire and replaces it’s Gorilla Glass? Or might they come up with an even more innovative product? What if GTAT becomes a takeover target of a 3M or GE? There are many plausable scenarios that temper my enthusiasm because seldom does any company have an unfair advantage for too long. Projections that look 3 years into the future become nearly impossible when technology advances at an increasing rate each year. I’m long GTAT and have made it a significant portion of my overall holdings but also a realist. I’ve seen too many sure things turn not-so-sure in my 40 years of investing.

My all means, dig into everything you can find about GTAT but don’t forget to keep a close watch on the competition and hungry jackels that would love to gobble up a company like GTAT and issue us shareholders their stock that has far less potential for spectacular growth. As much as it’s tempting to look at the rosy outlook and think about how financially secure this pick will make you, me and everyone else that buys it, the future could be quite different than imagined. Be sure to give equal weight to what’s happening that could impact GTAT negatively.

LikeLike

This seems like a great opportunity for a Monte Carlo simulation. I think the data you gave here is enough to do that.

LikeLike

When calculating factory output allow for furnace downtime for repair/maintenance. Some of this equipment is totally untested in full manufacturing mode over long periods of time

LikeLike

The number of furnaces might be 50% larger than 2,000. The tool price and capital spend for each analyst is all over the map. Furnace count could be 3,000 which would jump yield by 50%.

LikeLike

Barry,

Regarding WWDC, there’s enough buzz around iP6 with AAPL doing special deals to reduce current model inventory. Everyone who follows them knows it’s coming. But as much as I’d like to see AAPL do many things differently, they tend not to open up about anything until they’re good and ready. The maps debaucle is still fresh on their minds and they will test and retest to make sure it’s right before they announce anything to the world. My bet is they will tease and say good things are right around the corner. Keep in mind, it’s been a whirlwind of activity to build out the sapphire plant. I’m sure GTAT has their hands full with final installation and testing of their equipment. I just don’t think they’re ready yet for full scale production. And if we’re all thinking sapphire, AAPL certainly won’t say anything until all the bugs are worked out. What would you rather have….an iPhone6 without sapphire immediately or with sapphire in Aug/Sept? I’ll take a beatdown in price short term to load up on some more GTAT stock.

LikeLike

Carl the plant is supposed to be done by June. Fully ramped up. The math on July or August readiness comes down to the various metrics and what they are doing (furnace count, boule size, thickness, etc). Also, how much sapphire was grown in Salem over the last 6 months is a key factor as well.

LikeLike

Matt, here is where my personal experience and inner sense guides me. Installation on a scale of GTAT’s new plant is not something you can game by relying on previously set deadlines and start to immediately calculate full scale production the next day. First, this scale of production is completely new to GTAT. Much of the equipment is brand new and untested in day after day use at full scale thru put. The workforce is newly hired and needs a period of time to be fully able to keep things running. It’s not a zero to full speed instantly kind of thing. I bet you’d be amazed at the number and variety of issues they are dealing with at present. The plant is new, the equipment is new, the workers are new, the process at this scale is new, the amount of learning that needs to happen over the next 6-12 months is critical to future success. This is why my optimism is tempered by personal experience and understanding the nature of the task. For AAPL to release the iPhone 6 in September with sapphire screens in the quantities needed is a herculean task. Not impossible but given the above, I would find it completely amazing if they could pull it off by then.

LikeLike

” I would find it completely amazing if they could pull it off…”

Carl,

Legitimate skepticism, but ramping at hyper speed is a TC genius supply chain invention and it is why he’s CEO today.

LikeLike

Pkdecville,

This isn’t just a supply chain issue, it’s something called a learning curve. All new people working on all new equipment that hasn’t been used in high volume production before. I don’t care how smart those people are, they need to learn a sophisticated manufacturing process from scratch and then effectively mesh together as a team. It’s not done overnight. I’m sure there’s a step by step process that Apple wants to monitor closely and sample product from each furnace multiple times. Things will need tweeked, there will be new skills that need learned, adjustments made, daily successes and failures to learn from. After 6 months I’d have a better feeling about what can be expected as nominal daily output and extrapolate from there. It’s just too new now to make accurate assumptions.

LikeLike

A lot of the process is now automated to monitor and control the quality of the sapphire growth process. It still requires a learning curve but it’s not as manual as it once was. B

LikeLike

I agree with Carl. I wouldn’t assume Sapphire cover glass is a done deal for iPhone 6. If we look back at in cell touch, they started building out capacity in Dec 2010 and launched in 2012 with iPhone 5. Major manufacturing takes time to spin up, but I hope to be surprised with a sapphire cover glass on iPhone 6. As far as announcements at WWDC, Recent history when Apple launched iPhones at WWDC they did a software preview in Mar to give developers time to update their apps. Every single iPhone release has been accompanied by a new software major release so I’m skeptical about an iPhone at WWDC. But still think a August launch date is still in play .

LikeLike

Some of the analysts did forecast that the iPhone 6 would come out on iOS 7. The iOS 8 and HealthBook is really catered to the iWatch. Food for thought. TG did say 6 to 12 months to ramp up for Apple a few years ago in a CC.

LikeLike

Lots of healthy dialog, optimism, cautionary words, and lots of what ifs, all good to read and understand. My 2 cents follows with only what I know for fact, and why I took a position in GTAT.

1. A $587 million contract with Apple to make sapphire.

2. GT Technologies projects $600-$800 revenue for 2014 and 80% will come from Apple. This tells me GTAT is going to make bunches of sapphire this year in Mesa and possibly Salem for Apple.

3. Three of the four progress payments have been made by Apple. This tells me GT Technologies is either close to, or on schedule with Mesa.

4. Happen to know one of GTAT’s directors and he is expert in engineering, construction, and acquisitions. Very respected person in the E&C profession.

As far as the construction and operations of Mesa goes; I spent 35 years in construction and directed a department of 1000 professionals and 8,000 craftsmen worldwide, and see nothing extraordinary about the schedule for Mesa, it’s a fast track. As far as the operation of the plant and the learning curve, my guess is it has been in place for quite some time as they have likely sequenced the installation and start-ups in segments so the plant would go commercial in piecemeal fashion, not uncommon. And most important from an operations standpoint; there’s plenty of expertise from Salem that is likely up to their eyeballs assisting the Mesa folks and will go a long way to smooth out the learning curve.

I’m not a numbers person, but taking the projected $600-$800 for 2014 and then 80% of that revenue from Apple, and dividing by the estimated $10 price of each screen, it appears they will produce something in the neighborhood of 75 million screens this year. By the way, a huge variable is the “price per screen”, wonder how one could get a handle on how firm that number is.

But regardless, there’s a large plant in Mesa right now making boules and boules of sapphire, and Apple owns all of it.

LikeLike

One thing I would like addressed by Matt is what’s the liklihood that GTAT is still in tact 5 years from now? Assuming sales and profit projections are relatively accurate, what’s the chance GTAT won’t be bought out by a much larger concern? If GTAT stock quadruples to $55 per share and gets bought out for $60-70 it’s definitely a big win for those of us who are long but the momentum could effectively stop just as they are hitting their stride. I’m loving Matt’s long term priojections of $500+ in five years but just how realistic is that given the amount of M&E occurring in the technology space?

LikeLike

M&A sorry

LikeLike

The are a number of good reasons to buy into GTAT’s future as Bill elucidated above.

The key to the golden egg is (1) proof Apple is going to have a significant product that uses saphire in a major way (ie, display) (which I believe has strongly been implied through the size and ramp of the Mesa and now Salem plants); (2) an accurate date for this product release (the key).

There are a number of reasons to believe GTAT has an upside in the medium term. The information above would remove all doubt and, almost more importantly, provide the info needed for very profitable options buying.

The least risky, but slightly less profitable, strategy in my opinion is to buy 2016 jan options. Assuming the company has some sort of Apple deal and continues making progress on its other technology (Hyperion, Merlin,..), then this could be a very profitable company and very profitable trade strategy overall. This play would also avoid any near time stock price fluctuations associated with the market guessing when an Apple product with saphire will be released (ie, WWDC). One could just purchase stock at this low point, but that does not preclude a lower stock point in the future due to an unknown (2) above.

LikeLike

Matt:

Chris Burnett writing from NH. I am a long time holder of GTAT dating back about 5 years through the big boom and bust cycle for Solar. Owen is my Brother in Law. Anyway I was passing the Merrimack GTAT plant last Friday and decided to stop and see if there was any unusual activity. The parking lot was about 4/5th full at 3 PM and there was no unusual construction activity. There were a few construction contractor electric vehicles out front and masonry trucks out in the rear. The loading dock had 3 bays and one trailer. There was no clearing or excavation yet for the adjacent property.

It is hard to believe that any construction at this point would facilitate new product deliveries from the Merrimac NH facilities this year. They could very well be reconfiguring the pilot production lines inside the building and the electricians and masons could be part of that process.

I will be passing the plant every month or so and will give you updates.

Just as a general comment I have been very impressed with the quality and depth of some of your analysis. GTAT deals in fairly obtuse, leading edge and hard to grasp technology. You have done an excellent job of putting that technology into practical perspective and relating it to the near and mid-term business prospects.

Two areas I would like to further understand is the potential for the Hyperion cut Sapphire lamina to be to be used very high quantities eyeglasses market and thin cut silicon carbide to be used to greatly improve anode performance in Lithium Ion batteries. There is some indication there may be up to a 10x improvement in lithium ion battery performance with the right SiC design. The implications give the massive potential of electronics and electric car business. Some evidence that one recent partnership might help push forward the optics agenda but little feedback on the silicon carbide for batteries.

Chris

LikeLike

solar iPhone coming http://www.patentlyapple.com/patently-apple/2014/05/apple-granted-49-patents-today-covering-the-iphones-integrated-touch-display-solar-assemblies-sensors-siri-more.html

LikeLike