by Matt Margolis

GT held its Q4 2013 earnings conference call on February 24th and GT’s share price closed the trading session at $14.14. GT held its Q1 2014 earnings conference today and GT’s share price closed at $14.28, or an increase of just 1%. As a focused long-term deep value investor I was very pleased with GT’s conference call and today’s 7% drop in share price does not change my extremely positive view on GT’s future. As an investor I primarily focus my outlook 6 to 24+ months out and buy into names that have great technology and/or products but might be in the midst of a depressed market or a companies that are broken but have plans to transform its management strategy.

When I look a company like GT, I see superb leadership that continued to invest in the company’s future even when times were tough. GT’s technology suite of products are getting readied to take on new markets as well as capture markets that are returning from the doldrums. I view GT as a long distance runner that is just about to pick up the pace over the next several laps and distance itself from the competition. The first 4 plus months of the year have been relative “boring” to watch with a lot of chatter/rumors but no real action. However, over the next 3 to 4 months the action will significantly pickup as rumors turn into news and concept designs turn into product releases. The long time shareholders have all seen this kind of bumpy road before. My message to the recent investors in GTAT is to remain focused on the next 6 to 24+ months, which I expect will be very rewarding and exciting.

My role as an analyst is to inform and educate others of where I think a company is headed based on data points; including management comments, industry trend, job postings, patents and any other meaningful information I can get my hands on. As an analyst, who covets management’s commentary, I found today’s call very informative even if short-sighted traders took GT’s shares to the woodshed today. GT indicated to investors during the Q4 2013 call, that 2014 would be focused on the execution of its commitments in Arizona as well as its investment in new technologies that are expected to contribute meaningfully to 2015. So far GT seems par for the course, which is significantly better than my golf handicap.

Q4 2013 GT Prepared Remarks

While our primary focus during the balance of the year is to continue to execute on our commitments in Arizona, our aim is to position GT not only as an exceptional sapphire supplier to Apple but also as an unparalleled world-class supplier of sapphire material and equipment for a variety of customers.

In addition, many of the diversification and investment seeds that we have planted over the last several years in the LED, power electronics, advanced solar and industrial markets are expected to begin to bear fruit over the next 18 months. We are already supplying ultra -thin silicon wafers, exfoliated using our Hyperion tool, to a Beta customer in Asia and our commercialization plans for Hyperion, SiC, HVPE, PVD, HiCz and new Polysilicon products remain on track.

We are seeing significant interest in these new products and now expect equipment orders from these initiatives to be received during the latter part of 2014, with meaningful revenue recognition beginning in early 2015.

Today’s conference call highlighted some key developments within GT’s current operations.

- GT’s Salem facility: GT’s Salem, MA facility which was has served as GT’s R&D center over the last 6 months to support the development of the ASF 165 furnace and higher capacity systems will be converted to a dedicated sapphire production facility. GT’s Salem sapphire facility R&D efforts over the last 6 months, which might explain how GT was able to accumulate $113m in deferred revenue for Apple over the last 2 quarters.

- Merlin Product Update: The current plan is to start with pilot production of Merlin in 2014 and to launch commercial production in early 2015. Given stronger than anticipated initial interest, we are contemplating accelerating our investments and production capability. If you follow GT closely, you would remember that Tom Guiterrez, GT’ CEO was very excited about Merlin and indicated that if Merlin reached a 20% market share GT would consider bringing the production in-house. What is not clear is the level of investment and assumed production capability that GT has already invested and what exactly “accelerating our investments and production capability,” will actually do for GT’s top and bottom line in 2015. However, based on GT’s CEO’s comments, specifically, his “incredible optimism,” it already appears that Merlin is a hot commodity.

- Apple Material Operation in Arizona: GT’s headcount increased from 541 employees as of 12/31/13 to 1,000 employees as of March 29, 2014 and increase of 459 employees or 85%. GT indicated during the Q4 2013 call, that they expected headcount to reach 1,000 by mid-year, so today’s head count update looks to be a few months ahead of schedule. GT’s Arizona project has progressed from the “build out” phase to the “ramp up” phase and GT indicating that they are producing sapphire in Mesa. GT also indicated, that the “captive” ASF furnaces are “significantly greater” than 165 kg boule capacity and are “production ready”.

- Merrimack Expansion: GT is expanding its Merrimack, NH operations, within the existing footprint. GT will be adding sapphire production capacity in Merrimack to support our continued R&D initiatives, provide pilot production capability for our LED business and add space for some out our other new technology development programs. I pointed out GT’s Merrimack expansion plans a few weeks ago so this is not “new news”, but GT provided some color related to their expected use of the Merrimack facility

Returning & Emerging Markets

- Poly Prices: Spot Poly prices have risen above $20/kg for the first time since 2012 and GTM Research expects poly prices to reach $24/kg by the end of 2014. GT has confidence that can compete for the new expansion and cost reduction projects that are likely to proceed due to the industry shortage of polysilicon beginning in 2015.

- Sapphire Non-LED and Apple: Applications range from full “boat” sapphire to alternative solutions based on size or other constraints. GT’s objective is to have a “range of solutions” that start with “scratch only protection” (sapphire coating), followed by sapphire glass composites (sapphire laminate on composite glass) and lastly the “pinnacle” of the “best of the best” is pure sapphire. Plastics will also be used with sapphire.

My favorite TG Q1 2014 Conference Call Quote

But I mean, I would be insane not to offer it (Hyperion) to my existing customer (Apple).

The “Path” Forward

Over the last four years, we have indeed diversified our business, broadened our “footprint” in each of the markets we serve and succeeded in establishing a path to a base of recurring revenues.

We estimate that our new product initiatives provide GT with several billion dollars of incremental annual market opportunity.

We expect to grow with our existing customer base while adding new customers and diversify the geographies in which we operate.

Clearly, the objective is to grow shareholder value by expanding the size and breadth of the business in order to drive increased profitability.

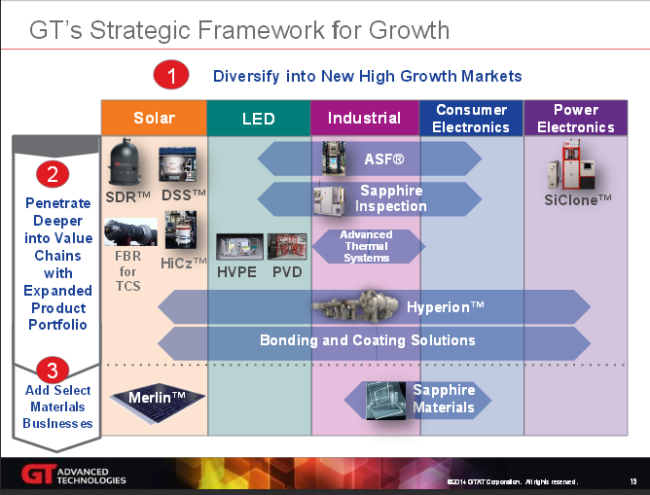

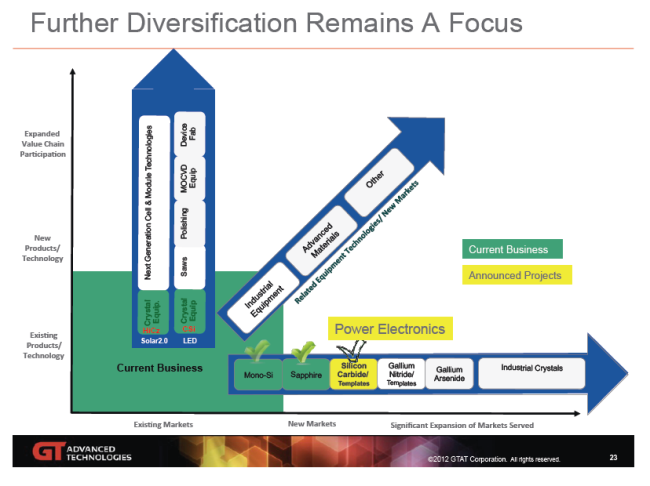

It is clear from the graphics below that GT has significantly diversified its business model in just 2 years. GT is not done diversifying its business strategy and will continue to grow its existing customer base and add new customers as well.

GT’s 2014 Strategic Framework for Growth

GT’s 2012 Diversification Focus

Full Disclosure: I am long GTAT

Good information Matt and I plan to hold. Nevertheless, I was disappointed to see GTAT management sell so much stock going into earnings report.

LikeLike

GTAT bought Crystal Systems for about $25 million in 2010 and after 4 years they have turned into almost $100 million sapphire gross business per month. This is a fantastic growth. What will they do with other technologies including Hyperion?

LikeLike

Yes, Thomas Gutierrez has been compensated over $25 million for running GTAT since he came on board, one would think he would not need to sell such a healthy portion of his holdings. It creates a perception problems. What he says in the conference call does not sync at all with selling off shares like that. I am a big fan of the Motley Fool approach on stocks, that the executives should have skin in the game along with the shareholders, and on that count he has not been exemplary.

However, I do agree that GTAT embarked on a solid strategy four years ago to be bullish and charge forward into markets that were at the time in the doldrums. The contract with Apple is the biggest prize so far, but there is plenty of evidence that they can grow in a lot of directions, with apparent market leadership in a lot of categories.

The Apple deal is key, and for GTAT’s sake and Apple’s sake the launch of the new iPhones is very, very important. If the 6 flops, Apple will take GTAT down with them. If the 6 is a big hit, Apple gains and GTAT gets a cash cow operation that will fuel their advances on all of the other fronts.

Matt likes a price target of $85 in 12 months, which I would love, but I like to take a conservative approach and just take the 2016 minimum earnings guidance – $1.50 – and look at a quite reasonable P/E for a growth company of 20 and arrive at $30 in two years. That is a double from today’s price, which is not too shabby.

GTAT is a leading player in each of the markets it is targeting, and each of those markets is growing at a healthy clip. They are not constrained by cash, and should things play out on sapphire they will likely be a cash generating machine for years to come. Thus, they should be able to exploit their leading position in other categories.

It is more exciting to be a GTAT shareholder when the price is going up without interruption, but GTAT doesn’t just have one disruptive technology, they have multiple, and I am along for the ride.

LikeLike

Matt, great report.

LikeLike

Just a note about TG selling his stock. Best as I can understand from Fidelity’s website is, it was an automatic sell on May 1. Automatic sell is defined as a plan “in place” to sell stock so the insider is committed to sell either on that date or by certain conditions, i.e.. price, quantity, date.

My take on this is TG has a plan in place to maintain a certain number of shares and sell on dates where the price hits a certain number,. i.e. on May 1 sell $2 million worth of shares if the price is at or above $16.

Excellent report Matt, thank you.

LikeLike

Hi Matt; Here is a possible GTAT topic discussion to develop: GTAT received its (3rd?) payment from Apple after the close of the 1st qtr, thus postponing its ameliorative effect until next qtr report. Thus, perhaps you could discuss what Q1 would have looked like if they had received payment prior to Qtr close; but more importantly now, what effect it will have upon the coming qtr results !!??!! I for one would appreciate such an exposition. Thanks for your consideration, Michael Cook (loyal reader)

LikeLike

Ynotcookit, Matt must be off obscurely analyzing something else, so I can tell you the impact that it would have had. Zero. The payments from Apple are a cash flow item, not a revenue item. Apple is fronting the money for the build-out of the Mesa facility, and starting in 2015 GTAT will start paying that money back. It is, in short, a loan by Apple so that GTAT doesn’t have to come up with the money until the revenue starts pouring in.

If you want to know more about the contract terms, check http://www.sec.gov/Archives/edgar/data/1394954/000110465913082405/a13-19507_1ex10d2.htm

I had asked Matt about the contract, and finally have a chance to read it for myself now.

LikeLike