by Matt Margolis

Background

GT announced a $58.6m Specialty Furnace order that is expected to be booked as revenue in 2H’14 on April 7th. On April 30th GT announced a series of strategic initiatives to leverage its Hyperion technology. On May 5th GT announced the release of its next generation ASF furnace that is capable of producing 165kg boules up from 115kg in the previous model. Additionally, GT announced that they expect to be commercially available in Q3’2014.

Update to Estimate

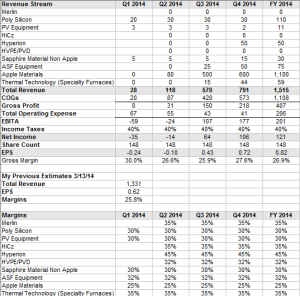

GT has made several announcements over the past several weeks that forced me to modify my 2H’14 estimates and add Hyperion and Specialty Furnace revenue to my model and increase my estimate for ASF Equipment sales as explained above. As a result of the recent announcement I’ve modified my 2014 street high revenue from $1.331B to $1.515B primarily driven by 2H’14 equipment sales. In turn my 2014 EPS estimate is moving up from $0.62 to $0.82 partially driven by increased gross margins, which added $0.06 to my 2014 EPS estimate. My gross margin estimate is now 26.9% up from 25.8% representing a 1.1% gross margin improvement driven primarily by additional equipment sales expected in 2H’14.

Although, I believe the iPhone 6 may arrive as early as June I have not modified my 2014 estimate to reflect any changes to my current forecast related to sapphire material sales to Apple. I am currently sapphire cover screens unit sales of 88m iPhone 6 units, 30m iWatches and 18m iPods. It is important to note that my unit Apple sales estimates also include unit sales to Apple to accumulate 1 to 2 months of inventory on hand heading into 2015 for the iPhone 6, iWatch and iPod.

My updated 2014 Revenue and Product Mix Estimate is below

Previous Analyst Round Table 2014 FY Estimates

GT’s 2015 and 2016 Upside Potential

My 2015 and 2016 estimates do not reflect the likelihood that GT will receive annual follow-up equipment orders related to its Thermal Technology equipment portfolio.

My estimates do not include the impact of Hyperion 4 likely being adopted in volume that is above and beyond my current estimates. Hyperion will likely be sold within a “total solution” for the growth, processing and bonding of Sapphire lamina. Hyperion will also likely be sold alongside GT Silicon Carbide furnace to create ultra-thin and relatively less expensive Silicon Carbide wafers. I expect both of these “total solution” options to begin gaining traction by 2014 and likely significant revenue on top of my 2015 and 2016 estimates.

Apple’s most recent purchase of LuxVue and its patented LED display technology will eventually land inside Apple’s devices and replace Apple’s current display with a more efficient and just as bright LED display, which will also improve the battery life. The foundation of LED displays are sapphire substrates and GTAT’s sapphire produced in Mesa will likely land inside Apple’s devices for LED displays by 2016. Lastly, Apple is currently focused on the manufacturing of the iPhone 6 and iWatch, however most industry analysts believe that sapphire cover screens will also end up on Apple’s iPad. The timing of sapphire cover screen’s addition to the iPad is likely tied to the availability and less tied to the price of the sapphire cover screens themselves.

The last product to watch that will be emerging from GT’s R&D lab is ultra efficient solar cells, including “triple junction solar” cells for consumer electronics. GT’s super thin and efficient triple junction solar cell is patented and is designed to support consumer electronics. Apple is currently very interested in extended the battery life of its devices and when Apple does introduce solar charging to its devices, GT will receive considerable consideration to supply the product.

The original focus for Hyperion project while under the direction of Twin Creeks Technologies was to develop ultra thin solar cells to cut the cost per watt to produce solar energy in half. GT has been referring to the progress made on solar cells with a “well-known” solar cell manufacturer in Asia for quite some time and I expect an announcement will be made shortly on availability and details of the product.

Price Target

I am maintaining my strong buy recommendation on shares of GTAT and a 12 month price target of $87.50 which equates to 17x my 16′ EPS estimate of $5.26 on $4.736B of sales and 31x my 15′ EPS estimate of $2.84 on $3.177B of sales.

Full Disclosure: I am long GTAT

Matt,

Since GTAT has made a move with their furnaces to start taking advantage of their technical edge in-house, wouldn’t it be an unsurprising move if they built out the Hyperion technology in-house also to become the premier supplier of thin sapphire and polysilicon wafers? Could we perhaps be witnessing the transformation of GTAT from being a supplier to fabricators to becoming a major fabricator themselves? I am sure they would not want to disrupt customers without a major incentive to do so, but if they offer a superior total solution, it would seem the value proposition for building that out in-house would be compelling.

LikeLike

Just leaked… Have you seen this yet? Possible legit leak?

http://inagist.com/all/463885682264387584/

– Moneytreezzz

Sent from my iPhone

>

LikeLike

Curious how you justify 17x P/E?

Don’t get be wrong. I’d be ecstatic if this happens. I’d have a lot of money in the bank.

But I’m curious to know why you think such a high P/E at that stage of growth is acceptable.

LikeLike

I actually believe it should be higher. Everything that has come out from management including job postings often include “prior experience with a rapidly growing company”. The business will be scaled up once new products gain traction.

LikeLike

@Matt

Agreed on growth. However, for 17x forward P/E, the company would have to show substantial potential to grow in 2017. And while I believe there will be growth, I’m wondering how substantial it’ll be to justify 17x P/E.

Either way, I’ll be happy. I’m just hoping the stock hits $40 by next March. The trade will pay for my wedding. LOL.

LikeLike

At Matt, I know it’s getting greedy for info. But could you venture a guess to where you think GTAT will be by Christmas? 6-month price target?

LikeLike

$30-40+ seems doable. A lot depends on timing of 2015 guidance.

LikeLike