by Matt Margolis

Apple submitted two applications to the Foreign Trade Zone (FTZ) No. 221 for approval. Apple’s application for Sub Zone designation at the Apple/GT facility was submitted to the FTZ office on December 17th, 2013 and Apple’s application for “Interim” Production Notification Application was submitted to the FTZ office on December 30th, 2013. The Interim Production Notification Application indicated that Apple had an aggressive go-live timeline of February 2014. The Apple/GT facility was granted a temporary C-of-O (Certificate of Occupancy) to commence with occupancy and production of Quick Start 140 area on January 10th, 2014. Quick start 140 was located in Module 1 of the Mesa facility and contained 140 “tools,” which are also know as sapphire growth furnaces.

Apple’s application for Sub Zone 221 designation was submitted to the FTZ office on December 17th, 2013. The Apple/GT facility was formally granted Sub Zone approval on March 19th, 2014. The Sub Zone approval was the final step required before Apple and GT could begin in earnest to manufacture intermediate components for consumer electronics for exports as indicated in their original Sub Zone application.

Apple Inc./GT Advanced Technologies Inc., Mesa, AZ, 221A, approved 3/19/2014 (S-5-2014)

Another interesting fact to point out is the Master Development and SOW agreement between Apple and GTAT is that the agreement requires any additional furnace purchases, would be negotiated in good faith prior to the second Milestone Payment made under the Prepayment Agreement. GT reported during their Q4 2013 conference call on February 24th, 2014 that they had received the second Milestone Payment from Apple. The receipt of the second Milestone Payment from Apple signals that the furnaces that were required to be purchased and deployed as part of this agreement were all ordered on or before February 24th, 2014.

According to Port Authority records, sapphire growth furnace deliveries began heading to Mesa, AZ on December 2nd, 2013 and the last known delivery was recorded on March 10th, 2014. I have tracked 1,265 furnace deliveries that have passed through Port Authority. Additionally, any and all domestic furnaces that did not pass through Port Authority (i.e. truck) would not be caught in my sapphire furnace fishing net.

I have assumed GT deployed $251m of PPE ($180m) and Inventory ($71m), which would account for 837 additional furnaces inside Mesa giving me a total confirmed/estimated of 2,102 furnaces. The book cost that GT assigned to each furnace that was deployed and taken out of inventory could be substantially lower than $300,000 per furnace. If, GTAT’s price per furnace is actually $30,000 lower than my estimate it would add almost 100 furnaces to my estimate, conversely a $30,000 increase would decrease my estimate by 100 furnaces.

Based on my correspondence with a sapphire industry expert, GT had previously touted their ability to ramp up 500 furnaces per month at ASF equipment customer locations. However, GT has already informed investors that they dedicated a vast majority of their ASF capacity to the Mesa, AZ sapphire effort, which would likely drive their drive GT’s maximum furnace ramp north of 500 furnaces per month. Based on the furnace delivery dates and GT’s touted ability to ramp up efforts and focus on Mesa I’m becoming hard pressed NOT to believe that the Apple’s Mesa Sapphire plant WAS likely operating at or near full capacity just days after the receiving the official unlimited go-live approval from the FTZ on March 19th, 2014.

Tracked Furnace Deliveries and Estimated GTAT Furnace Deliveries

My Estimated # of Furnaces Purchased/Deployed in Mesa, AZ

Apple’s purchase of additional Furnaces and Similar Furnaces will be made under the terms of Apple’s Master Equipment Purchase Agreement (the “MEPA”). Apple and GTAT will negotiate in good faith to execute the MEPA as soon as possible following the Effective Date, but in any event prior to the second Milestone Payment made under the Prepayment Agreement. Prepayment Agreement

We have dedicated the vast majority of our current ASF capacity to support this multi-year commitment. This has limited our ability to take additional ASF business in the near term and has restricted our ability to ship backlog on short notice (GTAT Q3 2013 Prepared Remarks)

GTAT 2012 Presentation on their Sapphire Equipment

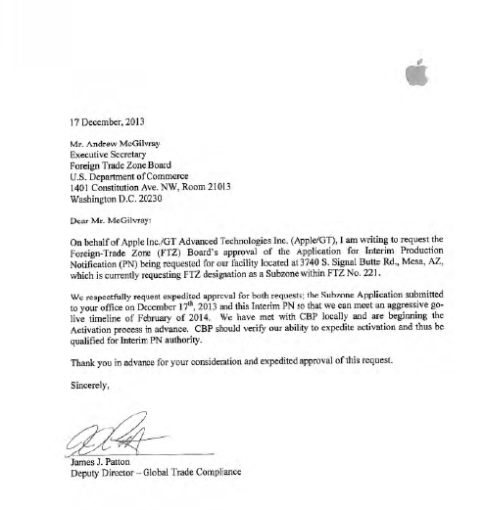

Apple’s Entire “Interim” Production Notification Application is Below

Full Disclosure: I am long GTAT and have no plans to buy or sell any holdings

Hi Matt,

Keep this rolling. Incredible sleuthing.

Much appreciated.

LikeLike

Matt, how do you interpret the furnace deliveries, most of which appear to be coming from TSM Tech Co. and SAS Co.? Do you think these are components (e.g. furnace vessels, etc.) or completed furnaces? If they’re completed furnaces, do you think they are produced under subcontract for GTAT, meaning GTAT will accrue revenue for selling them to Apple, or are they likely being purchased by Apple to augment furnaces purchased from GTAT?

I’m still unclear if GTAT is generating revenue from Apple by selling furnaces, charging per sapphire screen made, or both. It doesn’t seem reasonable that Apple should have to buy furnaces and then also pay for the output of those purchased furnaces, beyond some service charge for GTAT’s effort in operating the furnaces on Apple’s behalf (but not the full $5 to $10 per phone-sized cover screen produced that’s being discussed as potential “cost of production”). In short, I’m curious whether you think the large amount of revenue GTAT is projecting from the Mesa facility will come from 1) equipment sales; 2) per unit sales of sapphire screens; or 3) some combination of those two, with possibly some of the potentially available furnace revenue being spent with other equipment providers (SAS and TSM Tech) instead of GTAT in the interest of ramping as quickly as possible?

Very interested in your thoughts. Thanks for all the continued GTAT research efforts.

LikeLike

Most of these were completed furnaces units, which were paid for by GTAT bought using Apple’s $578M prepayment. GT will be making money through sapphire screen unit sales #2. Based on the shipments I am believing that GTAT subcontracted out the assembly of a lot of the Furnace units. GT deployed their PPE and took Furnace equipment out of Inventory and delivered those to Mesa as well. Apple will most likely owns the Diamond Wire Saws and Sapphire Lasers that were purchased for this project.

LikeLike

Matt first of all I want to thank you for your incredible work on uncovering unknown info on GTAT. Anyway you could compile all this great info into a article for seeking alpha over the weekend? We need to reach the masses with this bullish info. Thanks again Matt…

LikeLike

I can 🙂

LikeLike