The Obscure Analyst has initiated coverage of GT Advanced Technologies and has issued a $65 – 12 month price target. GT’s core business outside of Apple is heading into a very receptive macroeconomic environment that will trigger significant new orders across LED, PV and Polysilicon. The macroeconomic environment coupled with GT’s new technologies and innovations across LED, Solar and emerging markets will drive significant new bookings, that is expected to exceed $1B in the 2H 2014. Additionally, the Obscure Analyst expects Apple to roll out sapphire cover screens for Apple’s iPhone, iPod and iWatch in 2014.

Furthermore, a full Apple sapphire laminate adoption across Apple’s iPad and MacBook is not included in this estimate. A sapphire laminate on the iPad and MacBook could provide an additional $1.6B in 2016 annual revenue. Furthermore, if Apple, adds thin-film solar cells at $2-3 per device provided by GT, it could provide up to $1.2B of additional revenue that has not been factored into this analysis. Lastly, the price target does not include any new technologies that may emerge out GT’s 3/14/14 Technology Conference, that might have a significant impact on 2015 and 2016 sales estimates.

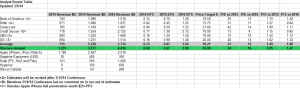

EPS and revenue estimates for 2014, 2015 and 2016 are in the image below:

Full Detailed Report is Below

I’ve been following GT Advanced Technologies for several years and their technological expertise and product roadmap is becoming more and more crystal clear every day (no sapphire pun intended). GT’s management team is full of extremely brilliant scientists and technology visionaries. The contract GT signed with Apple in November to provide sapphire material, which will be in the form of sapphire cover screens for mobile and sapphire laminate screens for iWatch and possibly more. Apple is not the cleanup hitter in GT’s technology portfolio, even though the Wall Street analysts are putting all of their time and effort into Apple and coming up with a valuation that is driven by the Apple business. I might be the Obscure Analyst on street, but unlike the overpaid under performing Wall Street analysts, I actually understand GT’s message loud and clear. If the Wall Street analysts could see the forest for the trees, they would realize GT is about to launch phase 2 of their war chest.

Apple is the lead-off hitter in what will be an American League lineup, similar to my Boston Red Sox, whose lineup was loaded from top to bottom with talent and key contributors. GT’s sapphire business with Apple will take off with amazing speed and grace, like a prototypical money-ball lead-off hitter, that sets the stage for the “other products” in GT’s lineup, to drive in an incredible amount of additional revenue and profits for years to come. The sapphire contract with Apple will be worth over two billion dollars in annual revenue in 2015, but Apple sales could be a minority share of GT’s revenue by 2016.

2014 Guidance

GT Advanced Technologies reported Q4 results on February 24th and gave the investment community an update on the progress in Mesa, AZ. Management gave investors even more confidence that GT has the ability to scale the operations in Mesa with Apple and meet their aggressive sapphire screen price objectives. As GT put it simply, “it is all about just execution” at this point.

The company maintained their guidance in 2014 at $600-800m in total revenue,with approximately 15% in the 1H 2014 and 85% in the 2H 2014. Sapphire revenue would make up over 80% of 2014 sales. During the November call, if you remember GT stated that the majority of their ASF (furnace) capacity would be tied up by Apple. In January, they reiterated their focus that 2014 will be all about delivering to Apple. My translation: a immaterial amount of ASF furnace sales will be converted from the current backlog to revenue in 2014. With that said, I am estimating sapphire materials sale excluding Apple to be $30m in 2014.

GT announced that they had deployed $180m of PPE (majority to Apple). Import records indicate that GT HK’s worldwide operations shipped furnaces from HK to Mesa, AZ. GT management also stated, that they would spend $500-600m in capital expenditures, with most of the heavy lifting occurring over the first half of the year. Assuming GT is spending $500m of capital expenditures and $180m that is being deployed from existing PPE this would allow them to purchase approximately 2,300 furnaces to grow sapphire boules. I also believe that Apple purchased an additional 1,000-2,000 furnaces that they will own inside Mesa which seems to aline with the ambiguous contract agreement between GT and Apple. The contract did contain language that GT would purchase Apple equipment and be reimbursed no more frequent than every two weeks. The additional furnaces purchased or not purchased by Apple have no impact to my current estimates.

I am estimating that $75-100m of capital, will be spent to build out approximately 50 Hyperion Ion Implanter machines. The Hyperion machines coupled with advancement in GT’s solar cell research will be used to produce GT’s solar cells that will be discussed in-depth by management on March 14, 2014 along with several other products coming in 2015. Additionally, I expect Hyperion to make its way to Mesa, AZ by the middle of 2014. Hyperion technology is likely to be used to produce sapphire laminates for Apple’s upcoming iWatch.

Apple Cover Story

The Apple deal will provide GT with the recurring revenue and consistent cash flow that it needs to nurture their investment seeds that have been dormant for the last several years. GT’s future is extremely under appreciated and misunderstood and they cannot and should not ever be looked at as a “sapphire materials company” or as “just a solar company” ever again. They are quietly establishing themselves as a leader in cutting edge, disruptive technology, and they are now well-funded, well versed and ready to take technology places we have only dreamed of. GT’s CEO drove this point home very early in the Q4 2013 conference call on February 24th (see below).

Although we have significant opportunities in sapphire, the GT story is not only about our emerging sapphire materials business. In fact, our entry into sapphire materials may enable us to expand into other materials segments once we have fully ramped the operation in Arizona. The many diversification and investment seeds we have planted over the last several years in the LED, power electronics, advanced solar and industrial markets are expected to begin to bear fruit over the next 18 months. We are seeing significant interest in our new products and now expect equipment orders from these initiatives to be received during the latter part of 2014, with meaningful revenue recognition beginning in early 2015

As some of you might have already noticed, I’ve been digging even deeper into GT’s technological tool set to figure out where these disruptive technologies can be applied. At this point it’s safe to say that GT has more tools than any hardware store in town! GT saw an opportunity in sapphire cover glass when they purchased Crystal Systems. GT dedicated the time and spent the money to monetize their expertise of the technology and create to hit a price point, that made the sapphire cover deal attractive enough, to land the Cupertino whale. During the Q&A section of last Monday’s conference call TG provided what I would characterize as his “money back guarantee” that GT will deliver related to output, cost and timing.

Our confidence comes from deep understanding of the unique technology that we’ve developed for these applications. And as I’ve indicated before, we’ve continued to progress on the performance of our ASF furnaces and the cost per millimeter that we expect to achieve. And so, we’re quite confident in our technology. And the rest of it is execution. I mean these are sizable projects and so execution has always an impact, but we’re confident. And as you know, we generally don’t give guidance unless we have a pretty good understanding that we’re going to hit it.

GT’s sapphire sales to Apple do not have any capacity restraints. The Mesa sapphire plant measures 1.3 million feet can comfortably hold 4,000 to 5,000 ASF furnaces at a minimum. I am expecting Apple to rolls out sapphire cover screens for the iPhone, next generation iPod and sapphire flexible sapphire laminate displays for the iWatch no later than Q3 2014. The iPod may surprise some of you, but an Apple job posting in January gave away a big clue that a new design was not only coming to the iPhone but to the iPod as well.

The iPhone and the iPod at quick glance are nearly identical, same dimensions but the iPhone has more functionality than the iPod because it operates as a phone and not just a hand-held device. The next Apple product on the docket is the iWatch. The iWatch is expected to sport a flexible display, will likely feature solar charging and may even sport two batteries; an integrated core battery and a secondary battery that could be charged by kinetic energy or solar power (possibly supplied by GTAT). I have assumed GT will have their Hyperion technology up and running inside Mesa by the middle of the year to fulfill the inventory buildup needed for the iWatch release in 2014. Additionally, if you look at GT’s recently issued patents (resulting from Hyperion beta testing) it gives a clear indication that GT has progressed Hyperion far enough to it’s one-of-a-kind technology to produce sapphire laminates. Apple already holds various sapphire patents including a laminate patent that describes taking two sapphire laminates in combination with or without glass to build a sapphire screen The Apple iWatch is expected to be relatively small (2 x 2 inches), which will require far less sapphire and time to ramp up sapphire laminate production using GT’s Hyperion technology.

There has been a lot of “noise” since November as to whether or not GTAT will be producing sapphire cover screens for Apple as well as discussions whether or not the screens would be full sapphire covers or laminates. The answer is GT will be supplying full sapphire cover screens for Apple’s iPhone and iPod. Sapphire laminates are a terrific cover option for the iPhone and iPod, however Apple will want to take advantage of the “performance upgrades” that will be made available by a full sapphire cover screen. To add some more validity to my Obscure stance, I’ve included some comments Tom made over the past two years regarding sapphire cover screens.

Tom Gutierrez – Comments on Sapphire Over the Past 2 Years

we believe that current sapphire fabrication techniques, excluding Hyperion, will support the adoption of sapphire in several applications including smartphones and point-of-sale systems

we also believe that there could be an incremental future market opportunity using Hyperion to create lower-cost sapphire laminates for broader mobile phone and after market applications

Sapphire laminates are expected to have some, but not all, of the attributes of a pure sapphire solution and are expected to have a cost structure that rivals current cover glass products on the market today

I don’t think it’s a cost advantage discussion, Jeff. I think it’s really a — if you’re in the box of cost, it’s performance, okay? The performance of the sapphire relative to scratch resistance, relative to breakage resistance, relative to optical qualities as such and it also carries a pizzazz with it, okay, that makes it a somewhat different solution than the existing solutions are. But what I can confirm to you is that we’re in the cost box. We’re in the cost box, it’s now about performance. Can we demonstrate and can our customers demonstrate as they’re piloting our capability whether or not it’s something that they want to do. There is a cellphone out there already that uses sapphire. The Vertu cellphone uses sapphire, and, as you know, all high-end watches use sapphire for the same reasons: scratch resistance, optical qualities, et cetera. And so it’s not a cost down, it’s a performance upgrade

Apple Product Roadmap 2014-2016

GT management confirmed that they have driven down the price to where they want, at this point I am estimating ASP of $10 per screen on average for the upcoming iPhone(s) and iPod. Apple’s iWatch is expected to support a flexible sapphire laminate display. The “slapwatch” patent filed by Apple indicates that the display will most likely be flexible in nature and sapphire laminates are a perfect candidate to fill the required job. I have estimated an average ASP of $4 per iWatch display. I am expecting the iPhone/iPod and iWatch to arrive no later than September/October 2014. My model estimates that sapphire covers will be used in 70% of Apple’s unit sales in 2015 and beyond. Apple has launched older iPhone models in India and may continue to keep around some lower cost models in select markets. My forecast of unit sales are derived by utilizing the smart phone industry trends provided by IHS. My calculation base Apple market share at 17% of the total smart phone sales. I feel my 70% penetration rate for sapphire for sapphire cover screens for the iPhone is reasonable but conservative and will provide a safety to my market share estimate if actual sapphire screen adoption percentage comes in above 70%.

Apple Product Roadmap 2014-2016 (Excluded From my Estimates)

What is not included in any of my Apple estimates is potential and likelihood that Apple adds sapphire laminates screens to the iPad and MacBook. Additionally, I have not included any thin-film solar cell revenue that could be received from Apple if GT supplies solar cells for Apple’s product lines in 2014, 2015 or 2016. The sapphire laminate screen pricing is a mystery, but I am estimated average ASP for sapphire laminates for the MacBook and iPad at $13 per device. In a bullish scenario, if Apple rolls out sapphire laminates for the iPad and MacBook it could add an additional $1.6B in revenue annually by 2016. Additionally if Apple added Solar cells at $2-3 on average per device this could additional $800m to $1.2B of additional revenue by 2016. The addition of solar cells across all of Apple’s devices and introduction of sapphire laminates in the iPad and MacBook represent an additional $2.8B of annual revenue or $3.00 EPS in 2016. My review of Apple’s technical product patents related to sapphire and solar charging strongly suggest that both of these events will happen and it’s not a question of if but when.

Other Lines of Business

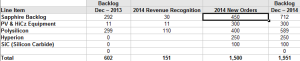

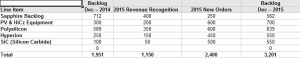

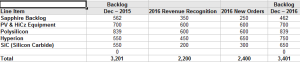

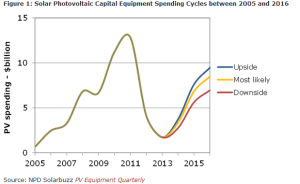

I expect GT’s existing backlog of $600m to be worth $450m by the end of 2014. I am expecting new orders of $1.5B to arrive in 2014 with approximately 77% of those orders to come from existing markets including PV equipment, sapphire equipment and polysilicon. The macroeconomic environment for poly, solar and sapphire are all extremely supportive heading into 2014. LED equipment utilization is at or near 100%, Solar is expected to run through the excess poly supplies and drive up the polysilicon price per KG from $21 to $25 by the end of 2014. Solarbuzz is already estimating a major comeback in solar capital equipment purchases by 2015. GT is already “well positioned on several on projects” in the Middle East, that are worth $300-500m annually beginning in 2016. GT Power Tec agreement is likely to contribute $100-200m in revenue in 2015 and 2016 alone. GT’s solar and PV business averaged a combined $600m in recognized revenue over 2010 and 2011. The upcoming capital expansion will reward low-cost, thin-film and innovative solutions with significant orders. The remaining $350m of new orders or 23% of 2014 bookings will come from GT’s Hyperion and SiC (Silicon Carbide) business

The Obscure Analyst’s Takeaway

The Apple deal will provide GT with the recurring revenue and consistent cash flow that it needs to nurture their investment seeds that have been dormant for the last several years. GT’s future is extremely under appreciated and misunderstood but Wall Street analysts and GT cannot and should not ever be labeled as a “sapphire materials company” or as “just a solar company” ever again. They are quietly establishing themselves as a leader in cutting edge, disruptive and game changing technological innovation. GT is prepared, willing and able to take their disruptive technology and created market niches places we have only dreamed of or seen in sci-fi movies. My research report was completed for all of the little people, who rely on Wall Street firms and their inability to deliver in-depth research on GT Advanced Technologies. Everything mentioned in this article, including; patent information, patent interpretation, job postings, market trends, products and industry trend, was readily available for anyone, who took the time and knew how to find it. I hope all of the Wall Street analysts take some notes of how to deliver an informative, in-depth research report. Lastly, I have to give thanks to my fellow street analysts for funneling information and informative ideas my way because this could not have been done without all of your support!

Full Disclosure: I am long GTAT and have no plans to buy or sell any holdings in the next 72 hours

If I can be frank, good for you for having balls to give a REAL price target and not hide behind some checklist-type-dcf model.

LikeLike

Would like to see a full P&L expectation. For instance, what are your gross margin assumptions concerning the different business segments? How should fixed costs develop? Interest expenses? Also, cash flow development would be interesting to see.

LikeLike

Hi Matt, good articles regarding GTAT. What do you think of this article and the effect it may have on GTAT. Would Apple invest heavily in GTAT for sapphire glass and ship to Asia for manufacturing, or just get its supply from companies in Asia. I’m holding long in GTAT but this is a bit concerning.

http://www.thestreet.com/story/12699193/1/countdown-to-iphone-6-sends-chinas-apple-concept-stocks-soaring.html?cm_ven=RSSFeed

LikeLike

I like the June assembly comments fits nicely to a early summer release. Apple has not given any sapphire screen production to its sapphire home button suppliers and they have no plans to add capacity.

LikeLike